Solar Panel Financing Buy, Lease, or Loan?

Solar Panel Financing

Buy, Lease, or Loan?

Solar Financing: Buy, Lease or Loan?

Solar Financing is an integral part of solar installations, so it's key to understand the different financing options available.

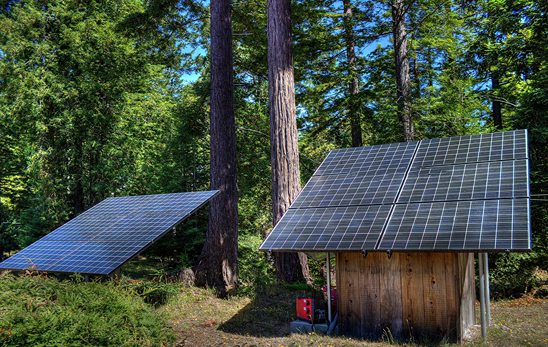

Solar panels are an asset that can increase in value, save you money, and increase your energy independence.

There are two important factors to consider:

the cost of entry and the ease of installation.

To choose the best option for solar panel financing, you need to figure out the estimated costs, what you can afford, and the different reasons to finance before deciding to invest in solar.

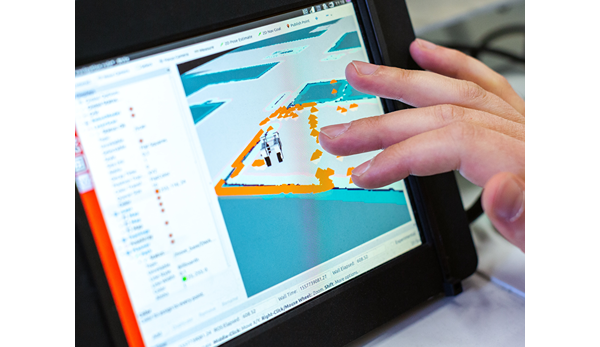

Solar Finance Calculator

Enter Loan Amount

$ 10000

Enter Annual interest

% 5.75.

Enter Repayment Period.

Years 7

Your Monthly Payment:

Does Solar Financing Make Sense?

Solar Loans are a great financing option when you want to purchase a system but don't have the cash on hand to buy. With many solar energy Loans, you can finance the entire cost of your system in exchange for a lifetime of savings on your energy bills.

Let's see how Loan payments stack up against your energy savings when you take out a $10,000 Loan at 5.75% interest over 7 years to finance your solar system.

What you pay in Loan interest & fees $2,171.

How much you Save on energy bills $29,000+.

You'll pay a few thousand dollars more in loan interest and fees, but you stand to save over $29,000 in energy bills over the life of your system.

Three Reasons for Solar Financing

There's a lot to consider with financing: you're probably not buying solar purely for the return on investment (ROI), but getting this return is certainly one of the more enticing factors.

Three reasons you should consider solar panel financing:

1. Ditch the Utility Company

Roll back your meter the moment you flip the switch. You can reduce or completely eliminate your electric bill from day one.

Take into consideration how much you're going to spend buying the solar system and how long the system is going to take to pay for itself by offsetting your utility bill costs over the years.

2. Keep the Incentives

If you take out a loan, you can claim the 30% Federal Tax Credit as a reward for investing in renewable energy. Applying that credit to your loan can help accelerate the payback schedule.

Companies who offer solar leases or PPAs keep the credit for themselves, which decreases the value of your investment.

3. It Pays to Go Solar

Even with loan payments, a $10,000 grid-tied system can pay for itself in about 6 years. Since most solar panels are warrantied for 25 years, there's plenty of time left to reap the rewards of cheap, renewable energy.

Solar Financing - Buy, Loan, or Lease?

If financing your solar system is your best option, three main financing solutions are available to help alleviate some of the costs, all with their own advantages and some disadvantages.

Why Buy Solar?

There are many reasons to buy; most importantly, when you buy it, you own an asset. Of course, solar panel financing can be expensive, so the money you invest upfront will be substantial. In most cases, you can claim the interest paid on your Solar Loan to purchase the system as a deduction on your taxes, something you can't do with a Solar Lease.

Solar Panel Systems are very reliable; they hardly ever need maintenance - aside from a scheduled inverter replacement a decade or two later. Inverters come with a warranty of 10 years (upgradeable to 20 or 25).

Why Lease Solar?

Solar panel leasing and PPAs (Power Purchasing Agreements) are options if you're more concerned about offsetting your power bill and using renewable energy sources instead.

Solar PPAs vs. leases vary to some degree, but they both allow you to have solar power installed without having to pay for a system.

However, you'll discover that you will pay the leasing company more than twice as much as it would have cost you to purchase the system yourself with Solar Financing.

One of the main advantages of leasing of solar system is that you are not responsible for maintenance, upkeep, or operations. That falls under the responsibility of the lenders, giving you some added peace of mind, especially if your solar system is on a vacation home.

Why Solar Loans?

FHA PowerSaver Loans are available to qualified applicants in many states. These loans help cover the cost of solar panel financing and installation (among other green energy improvements) and come with a reasonable interest rate.

With a Loan, you're paying back both the solar system's costs and anything you owe on your mortgage, property taxes, etc, making any ROI or utility bill offset negligible until the loan is paid off.

Loans can usually be paid off within 10 to 20 years, which means you may be paying them off for the entire life of the solar system. By the time your loan is settled, you may need to replace components to keep your solar system functioning.

Buy, Loan, or Lease?

Here's a side-by-side comparison of some of the advantages and disadvantages of buying, loan, or leasing options when you go solar.

Solar Panel Financing

Buy

Pay the full amount up front.

You own an asset with durable earnings.

Keep the federal tax credit and any local incentives.

Maximum long-term savings.

Loan

You take on loan payments.

You own an asset.

You keep the federal tax credit and any local incentives.

A lower ROI than cash - but ...

But you will still make a healthy profit off your system.

Lease

Pay nothing up front.

You do NOT own the system.

You can NOT obtain any of the tax credits or incentives.

Minimal ROI when compared to a loan or cash purchase.